Predicting the market

Predicting the market

How to use fundamental analysis and earn on news

Welcome to the ninth lesson of our Forex.Basic course.

In this lesson, you’ll learn:

-

the four most important types of news for a trader

-

what’s going on in Forex when important news comes up

-

which three strategies are commonly used for news trading

-

what the cons of news trading are.

Four most important types of news

About 20 major economic news announcements are made around the world daily.

Resolutions from major national banks, the reports and speeches of leading speakers, changes of various economic indicators—all of this impacts the market, and hence your trading. This news include reports on RBA Interest Rate Decision, Consumer Price Index, 6-Month Letras Auction, Labour Productivity, RBA Rate Statement, ISM New York index, ANZ Commodity Price, 4-Week Bill Auction, Gross Domestic Product, Markit Services PMI, Nonfarm Payrolls, BOC Rate Statement, Imports and Exports of countries with large economy, and various Factory Orders.

But only four types of news have the most significant influence on the market in every country:

-

unemployment rate (NFP)

-

inflation rate (CPI)

-

the GDP rate

-

the FED interest rate.

News that comes from the USA is the most important, as major currency pairs include USD. For that reason, to examine different types of news, we’ll use that from the USA as an example.

Nonfarm Payrolls (NFP)

The Nonfarm Payrolls report (NFP) comes out monthly on every first Friday. The NFP represents how the number of jobs and unemployment rate have changed in the USA.

When the NFP grows, the USD rate grows as well. When the NFP goes down, the USD rate goes down.

Consumer Price Index (CPI)

The Consumer Price Index report (CPI) comes out in the middle of each month. The CPI represents how the cost of living has changed in the country as compared to the previous report.

The Consumer Price Index report include the prices of all goods and services that people use in their everyday life: food, clothing, education expenses, healthcare, transport, utilities, leisure, etc.

When the CPI grows, the USD rate goes down. When the CPI goes down, the USD rate goes down as well.

Gross Domestic Product (GDP)

The Gross Domestic Product (GDP) report comes out at the end of each month. GDP represents the total market value of goods and services produced by the US economy throughout a month. GDP includes food production, defence industry, aircraft industry, shipbuilding industry, science, clothing and furniture production, education expenses, etc.

When GDP grows, the USD rate goes down. When GDP goes down, the USD rate goes down as well.

GDP value estimates are submitted at the end of each month and usually labelled as the advanced estimate, second estimate, and third estimate:

-

the advanced estimate is released at the end of January

-

the second estimate is released at the end of February

-

the third estimate is released at the end of March.

The advanced estimate of the GDP, the earliest one, usually has the most significant impact on the USD rate.

FED interest rate

The Federal Reserve Interest-Rate Decision (FED) comes out approximately once every month and a half. It influences interest rates for loans and deposits that the US banks offer.

Typically, an increase in the interest rate is followed by USD rate growth, and a decrease in the interest rate followed by its fall. How the USD rate will behave after an adjustment of the interest rate depends on the overall state of the US economy.

On a related note, a similar effect for the EUR rate is caused by the Refinancing Tender rate set by The Governing Council of the ECB, and for the GBP rate, a similar effect is created by the Bank of England with their reports on the repo rate.

What happens in Forex when important news come out

When any big news come out, quotes begin to fluctuate.

This usually lasts for a couple of minutes after the release. From then on, the market may keep being highly volatile for up to 30 minutes.

Up to two news releases a day may influence the market this way.

News trading in Forex

What should you do during the news release? This depends on what kind of trader you are.

Traders of the <b>cautious</b> type:

-

close all trades before the news

-

do not open new trades right after the news

-

return to trading after the high volatility period is over, and the market becomes stable.

Traders of the second type—<b>analysts</b>:

-

conduct a deep technical analysis of the market

-

formulate presumptions regarding possible values of the subject of their research, referred to in the news

-

select the most realistic scenarios for market behaviour and quote movement

-

set up pending orders before the news according to their selected tactics.

Before the news comes out, the previous value of the reviewed figure and its new expected value are published.

When the news is released, a new actual value for the reviewed figure comes into the picture.

If its actual value exceeds both expected and previous values, the currency rate grows.

If its actual value is less than the expected and previous values, the currency rate falls.

Traders of the third type—<b>historians</b>:

-

analyse historical data on the markets and in the country where the news is released

-

search for patterns behind the decisions that the government and the heads of central banks make, and calculate their probability

-

open orders before the news is released.

Cons of news trading

-

The costs of entering and exiting the market increase when spread widens.

In the previous lessons we showed you how spread grows when important news come out.

-

There appears to be a risk of negative slippage.

Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. It occurs when liquidity is absent.

Slippage may occur in several cases:

-

at the moment of opening a Buy or Sell order

-

at the moment of closing an order when you leave the market

-

when a pending order you set in advance is opened

-

when a pending order is closed.

Whatever type of trader you are, you need to be aware of upcoming news.

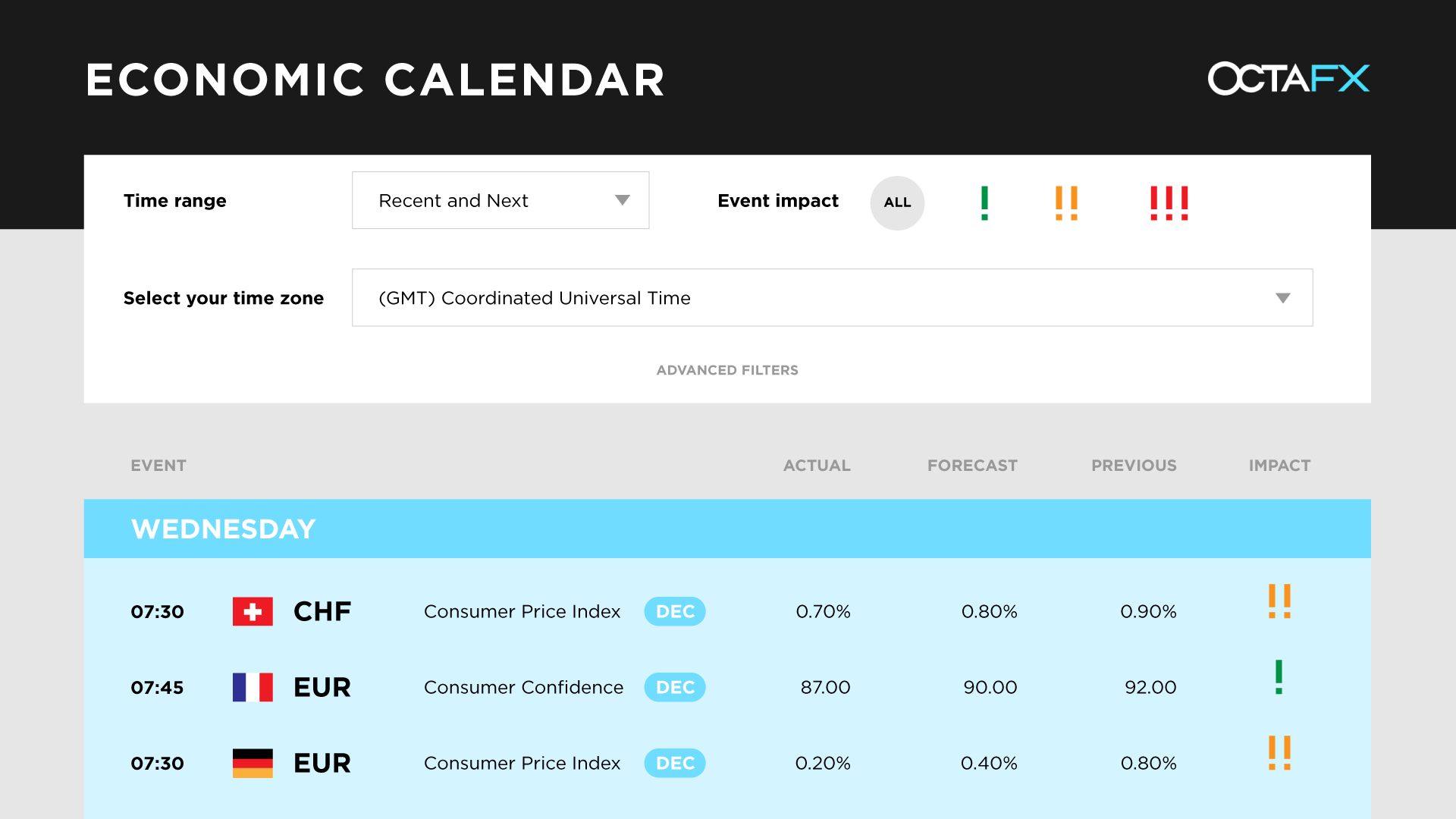

To be up-to-date on news, you can use the <a href=”https://www.octafx.com/markets/economic-calendar/”>economic calendar</a>.

The calendar bundles all data on economic news:

-

how important the news is (high, medium, or low)—the most important are marked with (!!!)

-

currency of the country

-

short description

-

previous, expected, and actual values.

Let’s repeat what we’ve learnt in this lesson:

-

News that comes from the USA is the most important, as all major currency pairs include USD.

-

Most important news releases influencing the market are:

-

the Nonfarm Payroll report (NFP)

-

Consumer Price Index report (CPI)

-

the Gross Domestic Product (GDP) report

-

the Federal Reserve Interest-Rate Decision (FED).

-

There are three types of traders: cautious, analysts, historians.

-

Traders are more cautious when news come out: spreads widen, chance of slippage grows.

-

The <a href=”https://www.octafx.com/markets/economic-calendar/”>economic calendar</a> is an instrument practicing traders always use.

In our next lesson, you’ll learn:

-

How to apply technical analysis for predicting price behaviour

-

What a trend line is and how to build it

-

How to find key levels

-

How to determine a channel and use it for trading

-

How to trade using Classic Chart Patterns.